As banks are getting ready to launch instant payments in South Africa, they have an opportunity to think about how additional innovations can be used to enhance their payment offerings, and how to make the most out of the Rapid Payments Programme (RPP).

The Rapid Payments Programme provides an exciting opportunity to innovate and enhance consumer access and experience when it comes to cost-effective, simple, fast payments. As we are nearing BankservAfrica’s deadline for the implementation of the RPP, we’re reflecting on what initiatives these could be and how they might add value to your business as a bank.

It is well known that BankservAfrica has mandated the three initial use cases for the RPP to be credit-push, pay-by-proxy, and request-to-pay. The ultimate goal is to make payments simpler, cheaper, and more accessible for the end-user.

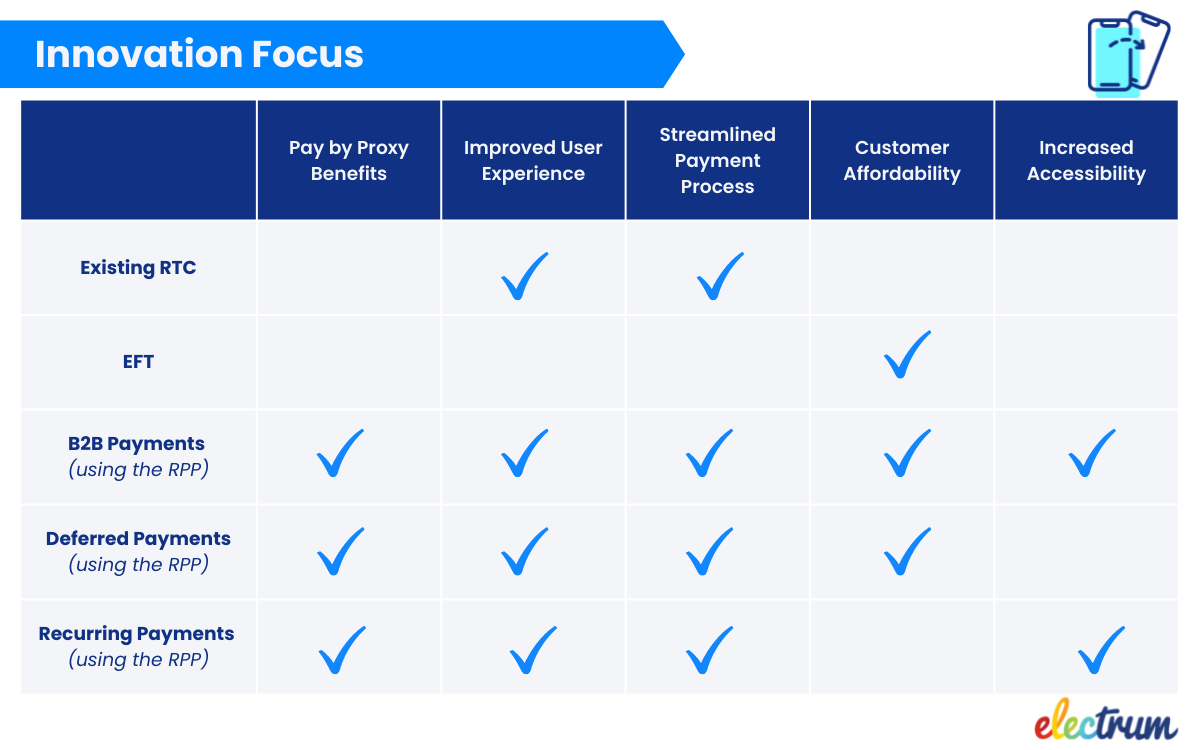

An innovative approach to using the functionality offered by the RPP has the potential to improve the user experience for your full customer base, give the end-user more control over their payments, and streamline business processes. Some examples of this broadened functionality are outlined below.

-

P2B and B2B payments: A transformational feature for micro-businesses, especially in rural areas, is that they can accept payments or pay invoices to other businesses via mobile phones without the need to go to a physical bank branch. This innovation is differentiated from current programmes such as RTC by the defining feature that it becomes a proxy-based payment – assisting your business customers to streamline their financial processes. Invoicing, sending payment reminders, or making payments to their partner businesses becomes much simpler, immediate, and even more mobile friendly.

-

Deferred payments: Set your merchant customers up to accept new forms of payment, and give your individual banking customers the option to defer specific payments. Significant benefits exist for both the merchant and the consumer in the use of RTP (request-to-pay): The consumer can defer the payment to a time that makes it more convenient or affordable for them, and the merchant can easily send invoices or reminders to the customer, requesting the payment. As with B2B payments, proxies can be used for the RTP notifications, making it easier and more efficient for your small business owner to set up and request the payment.

-

Recurring payments: Provide added support for your small business or merchant customers that run subscription-based payments or contractual payments by offering recurring payments using instant payment technology. Similar to a debit order, banks and companies will be able to send a recurring RTP notification to the customer. In contrast to a traditional debit order or RTC transaction, these payments have the potential to be faster and cheaper for the merchant. Full control over the transaction, however, remains with the consumer as they can opt to accept the RTP or not.

Looking even further into the future and taking inspiration from mature instant payment programmes around the world shows us how the RPP could potentially grow in functionality.

Although not currently envisioned as part of the RPP scope, linking digital wallets and instant payments is a success of the Unified Payments Interface (UPI) in India where, as reported in November 2021, one out of four households in the poorest 40% of the country make use of digital payments.

The expansion into cross-border payments is another future use case and can be seen in the APAC region where, in 2021, Singapore and Thailand connected their domestic real-time payment systems (FAST and PromptPay, respectively) to allow remittances.

Refocus your payments strategy

Your business focus and payments strategy will guide your innovation roadmap, with various initiatives offering benefits to different aspects of your payments portfolio. Ultimately, leveraging the rapid payment rails to make payments as simple as possible for all users will put your bank ahead of competitors and boost customer acquisition and retention.

The South African Race to the RPP

In South Africa, we can make the most of our position to adopt instant payments than some parts of the world, and leverage the learnings and successes within our own innovations. We have seen the potential of the RPP use cases, and we understand some of the challenges to expect.

However, in order to put your business in front of local competition, you need to choose a technology partner who understands what is required to successfully innovate in the rapid-payments space. Speed to market, the ability to scale, robust software, and fraud mitigation are key components of a successful solution. Proven expertise in this landscape will ensure that the challenges explored above will not slow down your payments business.

Electrum builds reliable, robust software, quickly, so you and your customers are always ahead. Reach out to the team if you’d like to find out more about South Africa’s Rapid Payments Programme and how you can innovate to build a high-performance payments solution – we’d love to hear from you.

Helen Whelan

Helen Whelan is a Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape