Considering that paying bills is a universal practice, it’s no surprise that bill payments are listed among the top three digital goods and services in South Africa, according to our 2022 Digital Goods and Services Report. Bill payments make up 10% of South Africa’s total VAS market value, which is estimated to bring in R35 to R40 billion per month. This doesn’t lag too far behind prepaid airtime and data (28%) and money transfers (15%).

As consumers continue to seek out convenient and trustworthy bill payment services, the market is ripe for retailers to explore the benefits of incorporating bill payments into their VAS offering. It all starts with understanding the consumer values and behaviours that inform how bills are paid.

South African bill payments

In South Africa, MultiChoice/DStv leads the top five bill payment types:

Most consumers who participated in the survey reported making bill payments once a month, spending an average of R200 to R400 on bill payments. Importantly, they said they expected to spend more on bills in the next six months. This indicates the growing popularity and opportunity in focusing on this digital service. The forecast of higher spend can also be due to predicted tariff increases and inflation.

Preferred bill payment channels

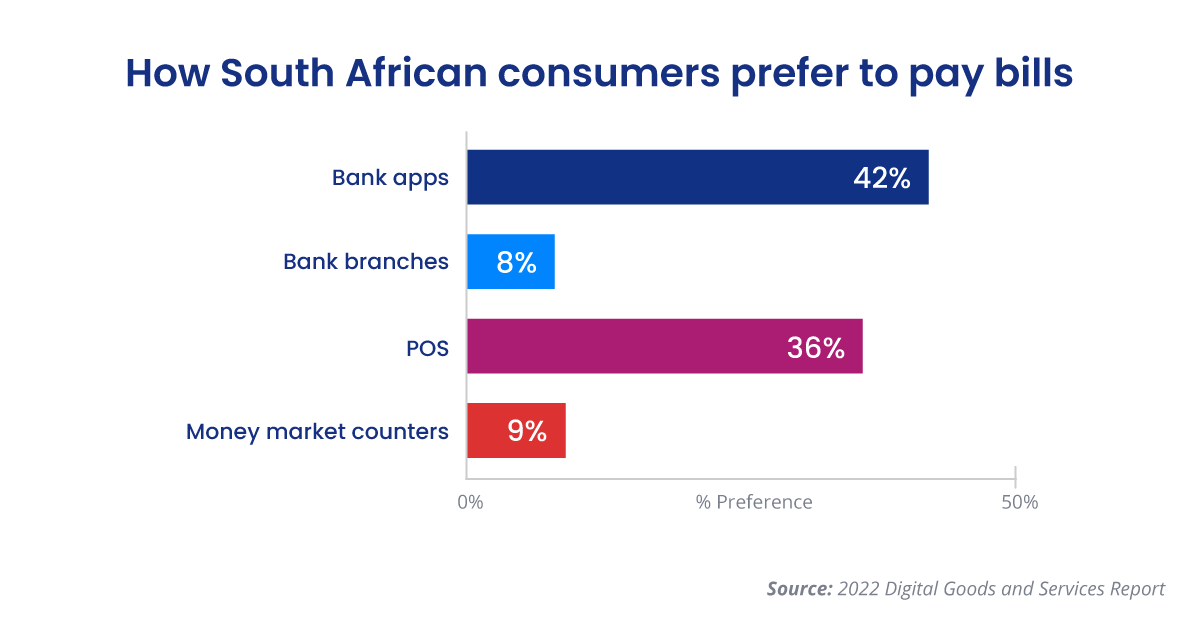

Research from the 2022 Report shows that bank apps are the most preferred bill payment channel - followed by retailer POS, retailer money market counters, and then bank branches.

Bank apps are often preferred because they are faster to use than waiting in a queue. Also, some large institutions - including municipalities, DStv/MultiChoice, security companies, insurers, and others - are often preloaded as beneficiaries on these apps, saving time that would be spent inputting account details and double-checking information. This is convenient for the consumer, as it saves time and minimises room for error.

Till points are regarded as convenient for combining bill payments with grocery purchases. Plus, consumers have the option to pay using either cash or a bank card, and it’s a trusted option.

In-store money market counters are fast and convenient for either card or cash purchases, as consumers can avoid the long queues at tills at the end of the month.

Convenience - the golden key

Convenience has emerged, front and centre, as a major driver of the consumer behaviours that inform how bills are paid. Findings outlined in Nielsen’s Quest for Convenience report indicate that South Africans care about finding simpler solutions:

-

40% of research participants said they want products that would make their lives easier;

-

36% shared that they would welcome products that bring them more convenience; and

-

20% said they preferred products that are tailored to meet their specific needs.

All these numbers translate into some of the behaviours that influence how consumers pay their bills, such as:

-

Relying on quick, one-stop experiences that fit into consumers’ routines; and

-

Using channels that they find to be the most accessible, easy-to-use, and reliable, to pay their bills.

By understanding these behaviours, retailers can better understand what consumers expect from bill payment services - and identify the opportunities they bring.

The opportunity for retailers to make the most of Bill Payments

There is an opportunity for retailers to actively play a role in creating bill payment solutions that give consumers the best possible experience. Offering comprehensive in-store bill payment services makes it more convenient for your customers who are already in the store to easily pay their MultiChoice/DStv, rates and taxes, or other bills, while purchasing other goods.

However, there’s also a digital opportunity, which can be leveraged. In addition to in-store bill payments, it can benefit retailers to integrate bill payments into their apps, so they can compete with banks. This begins with encouraging consumer adoption of an in-app VAS marketplace, which retailers can achieve a number of different ways, including:

-

Incorporating loyalty programmes into the VAS ecosystem. For example, linking app-based digital goods and services, like bill payments, to their existing loyalty programmes. This is a way to incentivise consumers to use retailer apps more.

-

Leveraging their existing reputations as offering convenience and the best customer experience, retailers can gain an advantage over competitors.

-

Having multiple digital goods and services on their apps, reassuring consumers that retailers’ apps can also service day-to-day financial needs.

Electrum’s software is designed to equip retailers to achieve scalable digital goods and services businesses, including for bill payments, through channels their customers use. The Digital Goods and Services Platform also helps retailers to rapidly get VAS offerings to market through existing integrations with multiple partners.

Thinking of expanding your VAS portfolio by introducing bill payments? Get in touch to chat about the options our Bill Payment solution has to offer.

Electrum Payments

Electrum provides transaction processing solutions to banks, retailers, and MNOs, helping them to find better ways to transact. As a vibrant and innovative SaaS company, we deliver industry-leading expertise and technology to solve real problems every day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape