New payment systems are continuously being launched worldwide, with PayShap here in South Africa a prime example. The successful implementation of fast payment systems requires substantial investments from governments, banks, and stakeholders in the payments landscape... So, can these roleplayers boost adoption through the use of incentive programmes?

Payment innovations are envisioned with the objective to meet the growing demands of consumers and businesses for faster, more reliable, safer, and more cost-effective payment methods. But often consumer uptake is slower than expected, or other industry players - such as smaller merchants - are resistant to offering these new methods to their customers. Incentive programmes are a way for the government and regulators to help boost the adoption of these programmes.

There are 3 key considerations to exploring the relationship between incentive programmes and new payment systems.

1. How transaction fees incentivise adoption

‘If there’s a favourable interchange, it creates its own incentive for the adoption of a payment system.’ Bank Executive survey participant

It is well understood that the cost of transacting plays a significant - often leading - role in impacting which methods consumers choose to make use of. Electrum’s latest research into payments in South Africa revealed that 77% of consumers surveyed prefer to pay friends and family using cash. This is due to a number of factors, including the perception that transacting in cash is free.

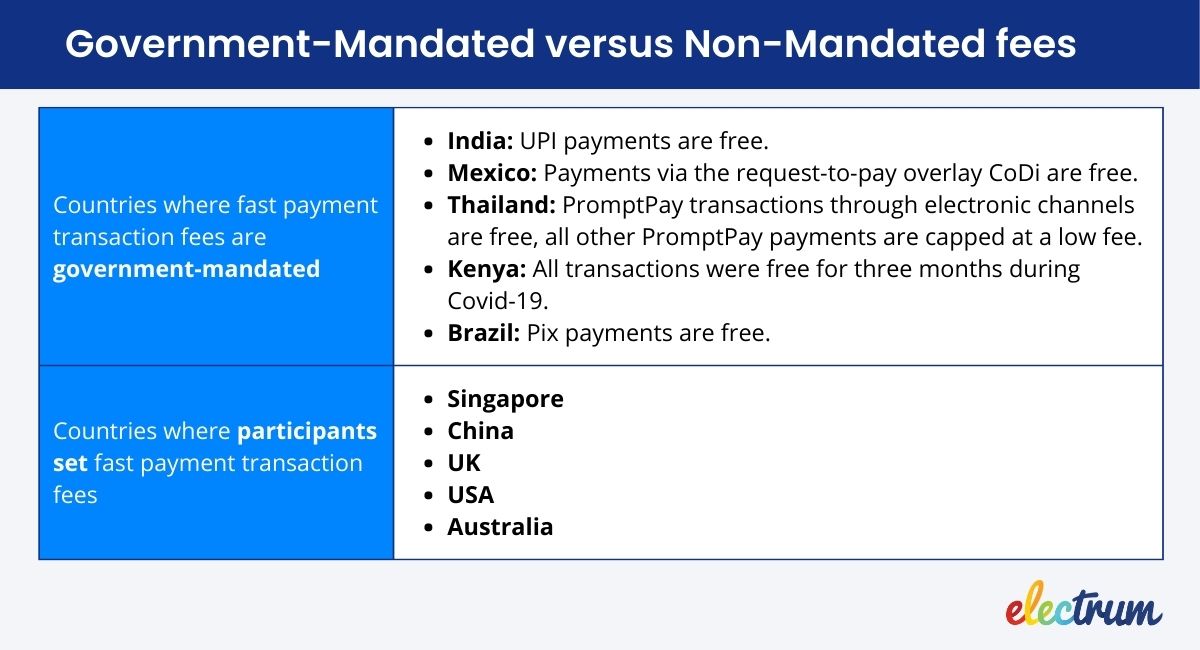

Whether fees are set by the government or not can play an important part in end-user transaction costs. While a number of countries have zero or low fees mandated by their governments, in most countries (including South Africa) a different approach is taken where the payment participants (banks and other players) are given the freedom to set their own transaction fees. The rationale in these cases is that low interchange fees (which continue to be set by the SARB) coupled with inter-bank pricing competition will drive down consumer transaction fees.

Vision 2025 states that ‘Pricing to consumers and businesses is outside of the scope of the SARB’s powers, but it is hoped that more affordable interbank pricing will be passed on in the form of lower fees to end users.'

The implementation of PayShap in South Africa

The first cohort of banks went live with PayShap in March 2023, with support for core use cases such as person-to-person credit transfers and proxy-based payments, and anticipating support for request-to-pay as well as merchant implementation via QR code scans in the near future. This was a carefully planned, phased implementation process following years of in-depth research, analysis, and development.

Many discussions have been around the cost of PayShap transactions, and whether or not consumers will actually use the new system. A number of industry leaders interviewed for the Modernised Payments in South Africa Report commented on the initiative and its adoption.

‘I think the current costing model is not yet incentivising the right behaviour. If I look at the way that banks are starting to adopt the RPP rails, they are emulating pricing strategies that are similar to RTC. This is instead of taking a brave step forward and asking ‘How should we be thinking about this differently and how should we be utilising this to fundamentally change consumer behaviour?’.

If we don’t take a brave step forward in our pricing strategies, we’re not going to change consumer behaviour and, therefore, adoption at the consumer level will not be evident.’ Bank Technologist survey participant

More importantly, the question is whether adoption will be enough to tangibly improve financial inclusion, which has been the key objective of Vision 2025 that ultimately drove the PayShap initiative.

2. Impact on consumer behaviour

Incentive programmes can potentially have an important impact on consumer behaviour. Such programmes can either be initiated by the government to drive adoption at a national level, or by individual companies to encourage customers to adopt their specific offering.

Consumers have been found to make use of payment methods that are, at face value, more expensive and/or less convenient if an incentive programme makes it rewarding enough. A prime example is that of in-store bill payments. While numerous mobile apps allow consumers to pay their bills online, some consumers prefer to do these payments in-store in order to make use of reward programmes which earn them rewards, loyalty points, or discounts.

‘It is more convenient for me to do it on my app, but actually, the extra eBucks are worth the hassle, so therefore, I’ll choose more hassle and pay at the point of sale. So, it’s not driven by what is the most modern or what is the most efficient.’ Challenger Bank Executive survey participant

India as a case study

In India, the government used incentives to drive consumer adoption of newly implemented fast payment systems. A government-owned mobile app was launched called BHIM (Bharat Interface for Money) in order to showcase the new UPI (Unified Payments Interface) scheme and build consumer trust.

The BHIM app itself was promoted in a number of ways:

-

The government used their app to make tax payouts to consumers to build familiarity and reinforce a positive user experience.

-

Incentive bonuses were paid to users for promoting the app, both as referrers and as referees.

-

Merchants also received cash-back bonuses for using the BHIM app to accept customer payments.

Additionally, India demonetised all 500 and 1000 rupee banknotes, announcing in November 2016 that individuals and businesses had until the end of that year to exchange these notes for new 500 and 2000 rupee notes. This move had two positive consequences: 86% of the country’s paper currency value was wiped out, which was a big leap forward in their drive to reduce cash reliance; and the door was opened to new methods of digital payment.

Although these initiatives did indeed result in consumer adoption of UPI, it is important to note that these incentive programmes were controversial and significant costs were incurred. The incentive bonuses for BHIM app users required a USD 65 million investment from the Indian government. The demonetisation initiative resulted in panic, cash shortages and a rush by consumers to exchange and withdraw banknotes - which even resulted in fatalities and shows the importance of the correct implementation of such incentive programmes.

3. Merchant adoption and incentive schemes

Interestingly, incentive programmes also have the potential to drive merchant adoption. A theme in the Modernised Payments in South Africa Report is that consumer adoption of payments is largely dependent on merchant adoption. If merchants (both in the large retail and the informal merchant sectors) do not implement a payment method such as PayShap, then there are limited reasons for consumers to use it.

Some governments recognise this fact and have invested significantly in boosting merchant adoption. A relatively simple incentive method is providing cash back to merchants from the government to help cover the costs associated with upgrading their payment infrastructure.

Singapore as a case study

In Singapore, the government has implemented the Singapore QR (SGQR) initiative that aims to standardise QR code usage for payments. The government further offers subsidies to small and medium-sized enterprises (SMEs) to encourage them to adopt SGQR and accept FAST payments.

During the COVID-19 pandemic, there were incentives for Singapore’s hawker centre stalls to adopt QR code payments in order to limit cash usage and keep the food markets functioning safely. Subsidies, as well as digital training, were provided if stall owners accepted a minimum number of QR code payments within a prescribed time period.

Merchant Discount Rates (MDRs)

MDRs are the fees charged by a bank to a merchant for payment processing services - and provide a more complex approach to incentivising merchant adoption when the rates are mandated to be free. MDR makes up an important part of an acquiring bank’s revenue, and when determined to be free, has the potential to result in financial losses for the banks.

-

In Brazil, the central bank (Banco de Brazil) declared zero MDR on Pix payments. A balance in this case has been found: a portion of the interchange fees gained by the central bank is shared with the relevant banks when off-us payments are processed, in a way to compensate the banks for their loss of MDR revenue.

-

India’s Finance Ministry has mandated zero MDR on certain payment types including UPI payments. Here, the Finance Ministry is not directly compensating the banks for these losses and this is a decision which is surrounded by much controversy in the country. Regulation is mandating retailers with an annual turnover exceeding Rs 50 cr to support UPI as a payment method, and the rationale is that banks will earn higher revenue from large overall transaction volumes (which incur bilateral or multilateral interchange fees between the banks) and savings deposits.

In conclusion, incentive programmes have shown that they can change consumer behaviour, impact merchant adoption, and positively influence the uptake and regular use of new payment systems. South Africa has the uniquely complex example of an informal transportation industry which comes with digital adoption challenges. Perhaps the innovative use of incentive programmes can play a positive role in this case?

Payments Research Report

Modernised Payments in South Africa

Comprehensive insights into the modernisation of payments in South Africa and the industry's progress towards meeting the goals of Vision 2025.

References and further reading

Helen Whelan

Helen Whelan is a Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape