With South Africa’s journey to modernised payments, comes discussion around improved financial inclusion and initiatives to drive it. However, Electrum’s recent research highlights that the concept isn’t always fully understood. This blog answers a few of the common questions around financial inclusion in South Africa’s payments landscape.

How is financial inclusion defined in a South African context?

The National Treasury 2020 policy paper on financial inclusion provides the following definition:

Financial inclusion is the provision and use of affordable and appropriate financial services by those segments of society where financial services are needed but not provided, or they are inadequately delivered. It is an important tool in the economic development of a country, just as financial exclusion is a significant constraint to economic and societal development.

It is important to note that simply providing broader access to financial services does not mean financial inclusion is improved for consumers. These services need to be adopted and made use of in order for any significant strides to be made.

The Centre for Financial Inclusion, an independent global think tank, defines full financial inclusion as a ‘state in which everyone who can use them has access to a full suite of quality financial services, provided at affordable prices, in a convenient manner, with respect and dignity.’

Is improved financial inclusion an objective of Vision 2025?

Yes, financial inclusion is one of the goals of SARB’s Vision 2025. As stated in the Vision:

Financial inclusion entails access to electronic payments but also access to savings, credit and insurance services. It may also involve providing greater access to cash services (e.g. cash-in and cash-out remittance schemes) as a way to increase trust in formal financial products and provide a transition towards electronic payments for underserved communities. Achieving this requires widespread collaboration across the entire financial services industry and business community. While payment systems alone cannot guarantee greater financial inclusion, the absence of safe, efficient, interoperable and cost-effective electronic payment systems would be an impediment to the efforts aimed at improving access to formal financial products and services. Payment systems play a vital role as a foundation for deepening financial inclusion by providing access to, and the effective use of, formal financial products and services for all South Africans.

How does improved financial inclusion impact poverty levels?

It is accepted by the regulators and industry roleplayers that payment systems alone will not guarantee financial inclusion. However, the Vision identifies that the absence of safe, efficient, interoperable, and cost-effective electronic payment systems would be a barrier to the efforts aimed at improving access to formal financial products and services.

The National Payment System (NPS) is viewed as a gateway to extended payment services for the financially excluded - with services such as savings, insurance, and credit contributing to improved living standards for South Africans.

It is the affordable access to and use of quality financial services that help consumers and small business owners generate income, manage irregular cash flow, invest in opportunities, and work their way out of poverty. Higher levels of financial inclusion also play a vital role in helping communities prepare for and respond to crises such as the COVID-19 pandemic, inflation, natural disasters, or economic shocks.

Is the goal for all South Africans to have a bank account?

Not in itself. The goal is that by using technology as an enabler, everyone in the country is able to participate in economic development. This may be - and usually is - achieved through possession of a bank account, but other modernised financial services will also play a role.

Research by Deloitte states that ‘in South Africa, financial inclusion for consumers has shifted from an access issue to a digital adoption and usage issue. For example, there are more than 80 million bank cards in circulation, assisted by the approximately 17 million South African Social Security Agency (SASSA) cards, and a mobile penetration rate of 157%. Yet there is a decline in the use of these accounts and an increased utilisation of cash in the informal market. For informal merchants, the challenge remains acceptance of electronic payments, which in turn is restricting growth on the consumer side.’

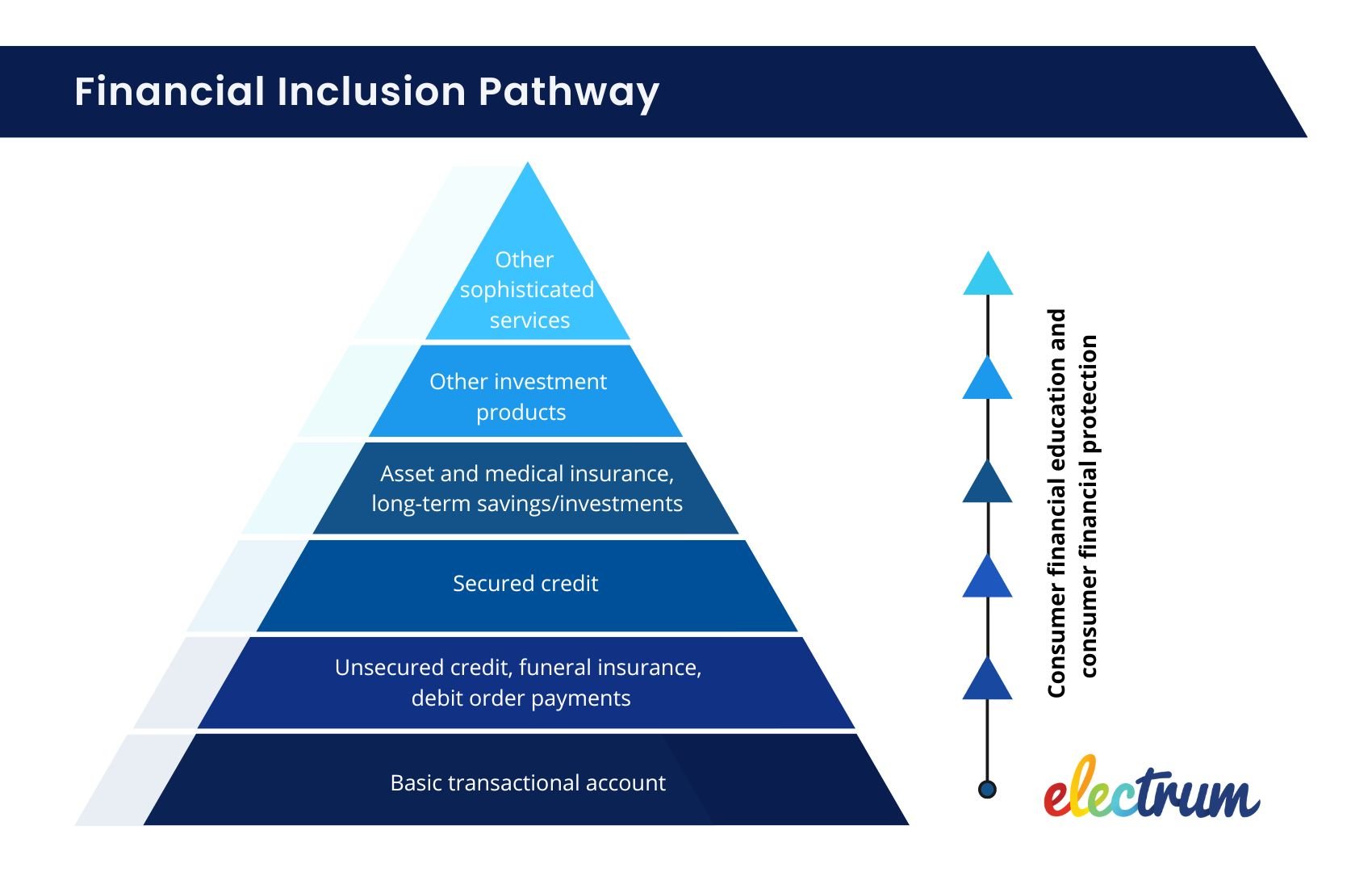

In South Africa, the pathway to full financial inclusion often begins with the acquisition of a basic bank account - this is generally followed by credit, insurance, and then longer-term savings. The pathways are dependent on the varying economic conditions of the individuals and often look different for those employed or self employed versus unemployed.

It is important that financial inclusion be supported by relevant and continuous consumer financial education and consumer protection at all levels of the financial inclusion pyramid.

How can we assess financial inclusion?

Three dimensions are used to assess and monitor financial inclusion:

-

Access refers to the capacity that financial institutions have in place or are using to provide financial services and products to satisfy the needs of the market, which translates to the ease with which consumers can obtain financial services. It includes both the physical and electronic reach of service provisioning and the affordability of financial services.

-

Usage refers to the uptake of appropriate products and services, as well as how they are used after acquisition.

-

Quality refers to the way in which financial service provisioning takes place. It includes consumer financial literacy and capability and market conduct issues.

Resources and further reading list

- National Treasury 2020 policy paper on financial inclusion

- The future of payments in South Africa - Deloitte Report

- SARB’s Vision 2025

- Centre for Financial Inclusion

Payments Research Report

Modernised Payments in South Africa

Comprehensive insights into the modernisation of payments in South Africa and the industry's progress towards meeting the goals of Vision 2025.

Helen Whelan

Helen Whelan is a Content Writer at Electrum. With a BSc (Hons) from Rhodes University, she enjoys the combination of creativity and technical topics that content creation at Electrum involves. Cats and coffee fuel her day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape