Research shows that there’s an undeniable and rapid move in favour of digital channels, including bank apps, for making transactions. 86% Of consumers in South Africa - an overwhelming majority, across various income bands - prefer to conduct their day-to-day banking digitally.

The question of digital banking in South Africa is not if there’s merit in investing in your bank’s app, but rather what elements should be focal points, and how you can win at implementing them. While we acknowledge that cash is still an integral part of how consumers transact, we would be remiss not to unpack the ever-growing opportunity that a comprehensive digital goods and services app portfolio presents to banks.

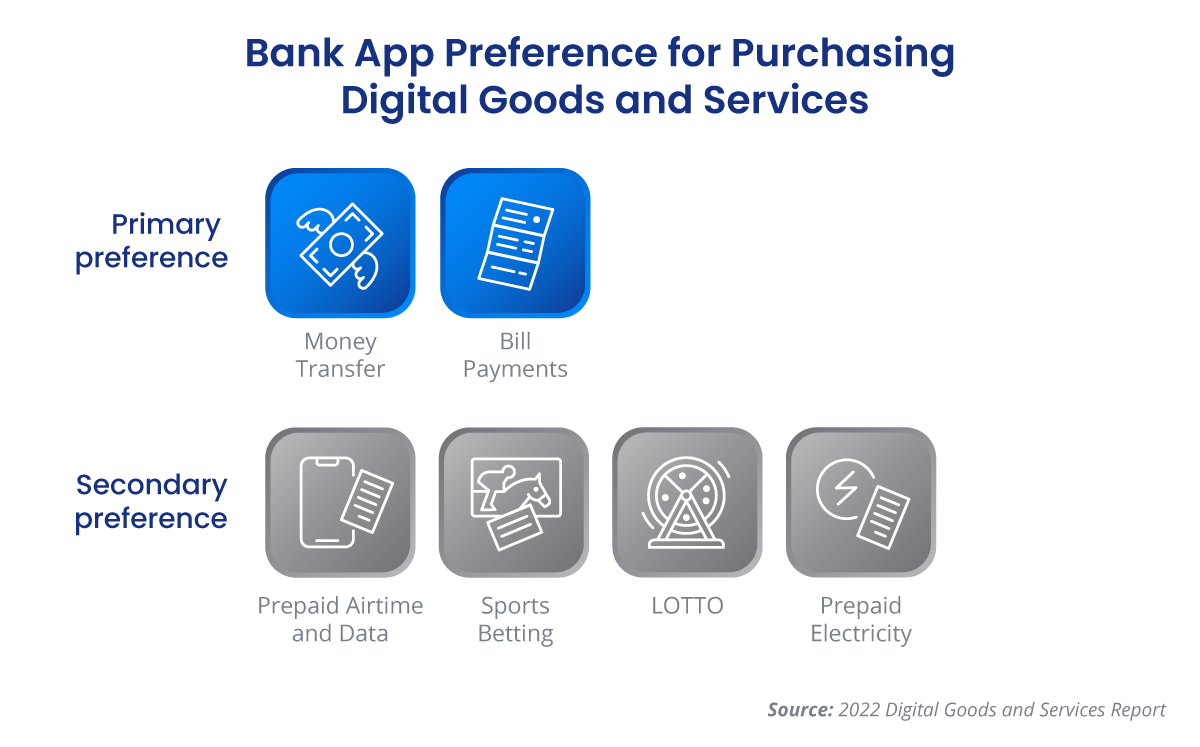

Research from the 2022 Digital Goods and Services Report shows that bank apps are significantly popular when it comes to VAS transactions:

This implies multiple opportunities for growth, which can happen when banks build on their in-app VAS portfolios. Consumers expect digital solutions that evolve as their needs do, all while offering convenience, security, and a broad bouquet of banking services to choose from.

How South African banks are performing digitally

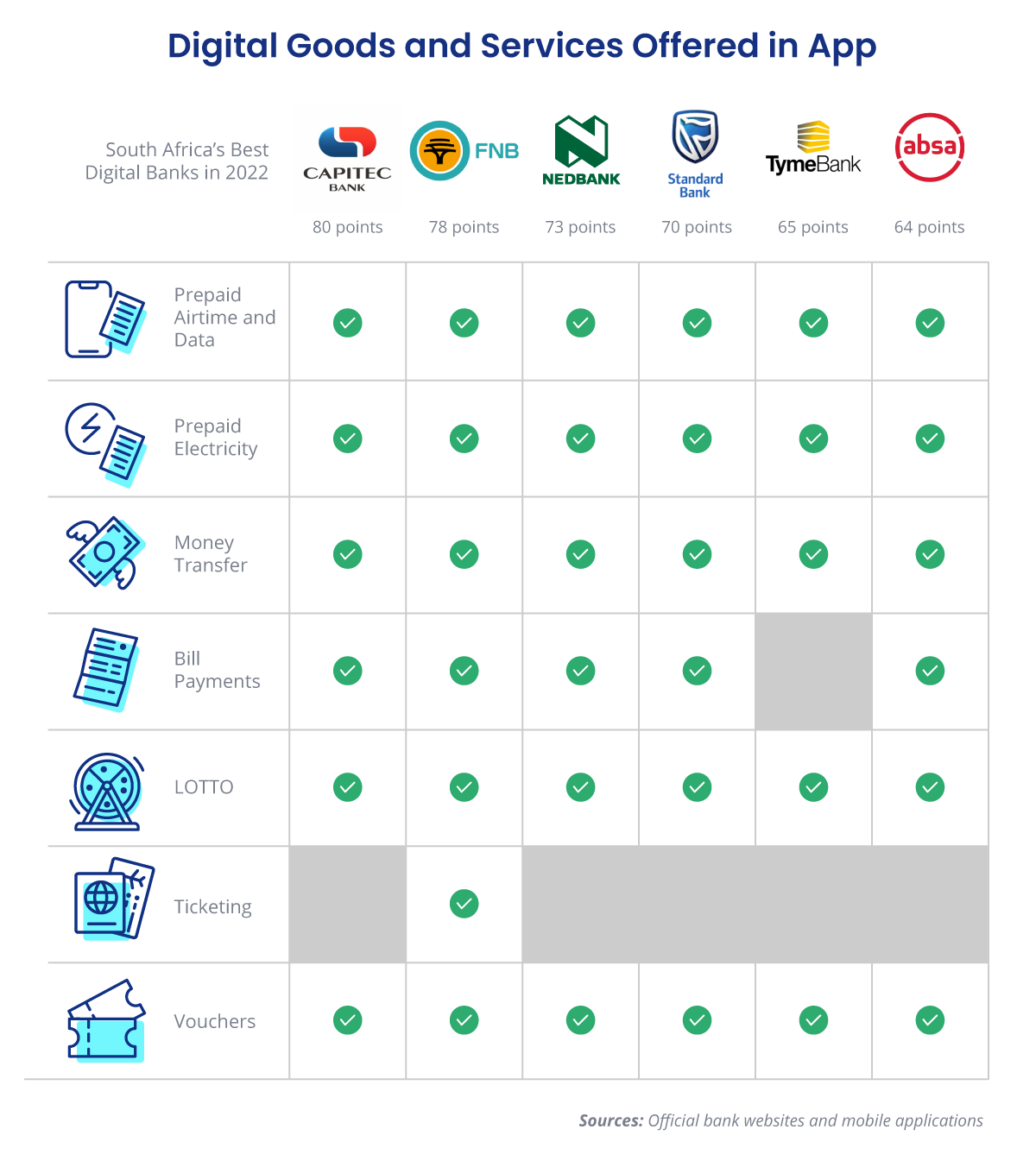

For more than a decade, InSites Consulting South Africa has been sharing consumers’ ratings of the country’s top digital banks. The banks earn scores based on a combination of their performances on computer web browsers and mobile apps. The success of these banks’ digital offerings was linked to customer satisfaction, with five key winning factors attributed to the top two banks, Capitec and FNB, including:

-

Providing trustworthy platforms;

-

Being easy to use;

-

Introducing innovative solutions;

-

The ability to do almost everything online; and

-

Consumers being able to personalise their accounts.

Digital goods and services are part of the broader bank app services that contribute towards achieving the winning factors listed above. Here is a quick overview of the in-app VAS offerings of South Africa’s banks that are leading the digital curve:

It is evident that South Africa’s leading digital banks are providing consumers with comprehensive digital goods and services offerings. Keep your business competitive by making sure your bank app offers an extensive VAS portfolio.

How to offer the best in-app digital goods and services

1. Respond to market demands quickly

In an increasingly digital world, you can always count on things evolving. Being responsive to market demands through continuous innovation can help you create a future-fit VAS marketplace with your bank app. This can increase customer satisfaction and loyalty, as you’ll be able to meet, and perhaps even exceed, your customers’ expectations.

2. Make it easy to expand your digital goods and services portfolio

In addition to meeting rapidly changing demands, it’s essential to have easy segues into expanding your VAS portfolio. You can bolster your marketplace by either adding completely new services or partnering with new and additional service providers for your existing offerings. The more options your bank app offers, the more reason your customers have to purchase digital goods and services through your bank.

3. Offer the best pricing

Affordability is paramount when it comes to digital goods and services. Consumers want to feel that they are getting the best deal for their money. So, banks need to keep the costs low, while being able to process high transaction volumes. Ensure you can offer your customers the best rates by leveraging the best commercial agreements with service providers.

4. Increase your coverage

Banks can buy digital goods and services from multiple suppliers, through various aggregators, to sell to consumers. However, establishing partnerships within this complex system takes time and effort. By partnering with a software provider that is already connected within the system, to multiple aggregators, banks can increase their coverage of VAS products. This will let them serve a wider range of consumers, as well as ensure fewer failovers and associated abandoned carts.

5. Provide an always-on service

When purchasing VAS products from a bank app, customers expect to have access to these services all day, everyday. Our research from the 2022 Digital Goods and Services Report has found that this is one of the reasons bank apps are preferred. Therefore, it’s beneficial to have features in place to ensure that your services do not go offline. One way of ensuring this is integrating with multiple service providers, so when one supplier cannot deliver, transactions can be rerouted to a different available supplier.

6. Offer a superior user experience

Ensure that your bank app is user-friendly so that users can easily find their way to the Digital Goods and Services they are looking for. If your customers know that they can expect a straightforward, consistent purchasing process every time, they’ll be more inclined to return to your app.

7. Link to loyalty programmes

Once banks have an established VAS offering, they’ll start to find synergies between their existing value-adds, such as loyalty programmes, and Digital Goods and Services. This can add to a positive service experience for customers, even though they may be making transactions remotely. An example of a bank that has done this successfully is FNB. The bank has linked its eBucks loyalty programme to travel bookings (and it is the only leading bank that offers in-app travel purchases as a value-added service). This feature gives their customers easy access to travel discounts and specials, which can be applied from within the app.

Electrum’s Digital Goods and Services Platform gives banks access to multiple existing integrations with aggregators and VAS service providers. This means you can roll out the VAS portfolio in your bank app and take it to market in a quick and seamless process. Features of the platform, like preferential routing, can give banks more coverage on certain VAS products, decreasing the risk of services going down when one provider goes offline. This results in a reliable offering, which provides customers a pleasant experience, and the bank with guaranteed VAS transactions.

By offering comprehensive digital goods and services through their apps, banks give consumers more opportunities to interact with them. This increased frequency of use could contribute to consumers becoming increasingly comfortable with using your bank app for their other daily financial activities. This can help to foster higher levels of loyalty among customers - increasing your bank’s revenue and gaining a competitive edge.

An example of successfully expanding a VAS marketplace to address consumer demand

Just Released

Case Study: Bank Boosts VAS Portfolio with LOTTO

It’s clear from the case study that the opportunity for in-app VAS offerings is far from exhausted. Banks can still be proactive about not only improving the user experience, but also gaining loyal customers in the long run.

Contact us to explore how you can grow and make the most of your bank app’s offering with Electrum’s Digital Goods and Services Platform.

Electrum Payments

Electrum provides transaction processing solutions to banks, retailers, and MNOs, helping them to find better ways to transact. As a vibrant and innovative SaaS company, we deliver industry-leading expertise and technology to solve real problems every day.

Electrum Newsletter

Quarterly insights and news to help you keep up with the latest changes in the payments landscape